Stock Exchange Bulletin

Financial Statement Release

February 13, 2025, at 8.00 a.m.

The last quarter saw a significant EUR 1.4 million profit improvement despite a decline in revenue

October–December

-

Comparable revenue totaled EUR 12.5 million (14.2) and decreased by 12.4 percent. Revenue totaled EUR 12.5 million (14.3) and decreased by 12.5 percent

-

Comparable EBITDA was EUR 0.8 million (-0.4) and EBITDA EUR 2.2 million (-0.8). Comparable EBITDA percent was 6.4 (-2.7)

-

Comparable operating result was EUR 0.3 million (-1.0) and operating result EUR 1.8 million

(-9.1). The operating result includes a profit gain of EUR 1.3 million from the sale of the Solteq Care business. Comparable operating result percent was 2.7 (-7.2) -

Earnings per share was EUR 0.03 (-0.43)

January–December

-

Comparable revenue totaled EUR 50.9 million (54.2) and decreased by 6.1 percent. Revenue totaled EUR 50.9 million (57.7) and decreased by 11.8 percent

-

Comparable EBITDA was EUR 2.9 million (-1.7) and EBITDA EUR 4.1 million (8.7). Comparable EBITDA percent was 5.8 (-3.1)

-

Comparable operating result was EUR 0.7 million (-4.6) and operating result EUR 1.8 million

(-3.5). Comparable operating result percent was 1.4 (-8.4) -

Earnings per share was EUR -0.06 (-0.28)

-

Solteq Group’s equity ratio was 30.9 percent (30.4)

-

Net cash flow from operating activities was EUR 1.6 million (-5.3)

-

Comparable revenue will decrease slightly, while the comparable operating result will improve significantly. Excluding the divested healthcare software solutions business, comparable revenue was EUR 48,818 thousand in the financial year 2024. Comparable operating result for the financial year 2024 was EUR 710 thousand.

Key figures

| 10-12/2024 | 10-12/2023 | Change % | 1-12/2024 | 1-12/2023 | Change % | |

| Revenue, TEUR | 12,475 | 14,265 | -12.5 | 50,869 | 57,655 | -11.8 |

| Comparable revenue, TEUR | 12,475 | 14,244 | -12.4 | 50,869 | 54,183 | -6.1 |

| EBITDA, TEUR | 2,213 | -822 | 369.3 | 4,073 | 8,695 | -53.2 |

| Comparable EBITDA, TEUR | 794 | -378 | 310.1 | 2,944 | -1,662 | 277.1 |

| Operating result, TEUR | 1,758 | -9,090 | 119.3 | 1,809 | -3,541 | 151.1 |

| Comparable operating result, TEUR | 339 | -1,026 | 133.1 | 710 | -4,575 | 115.5 |

| Result for the financial period, TEUR | 591 | -8,281 | 107.1 | -1,211 | -5,380 | 77.5 |

| Earnings per share, EUR | 0.03 | -0.43 | 107.1 | -0.06 | -0.28 | 77.5 |

| Operating result, % | 14.1 | -63.7 | 3.6 | -6.1 | ||

| Comparable operating result, % | 2.7 | -7.2 | 1.4 | -8.4 | ||

| Equity ratio, % | 30.9 | 30.4* |

* The comparative information has been adjusted; deferred tax assets and deferred tax liabilities are presented on a net basis. In the comparison period they were presented on a gross basis.

CEO Aarne Aktan: The last quarter saw a significant EUR 1.4 million profit improvement despite a decline in revenue

The fourth quarter capped a year of consistent result improvements throughout 2024. During the fourth quarter, the comparable operating result was EUR 0.3 million, which was EUR 1.4 million better than in the comparison period. The improvement in profitability, driven by successful cost management, was significant, particularly considering the revenue decrease of EUR 1.8 million from the comparison period. Both segments diminished in revenue, generating a comparable revenue of EUR 12.5 million for the company. During the review period, the market situation was tougher than estimated, leading to a profit warning in October 2024 and a lowering of the profit guidance on comparable revenue for the fiscal year.

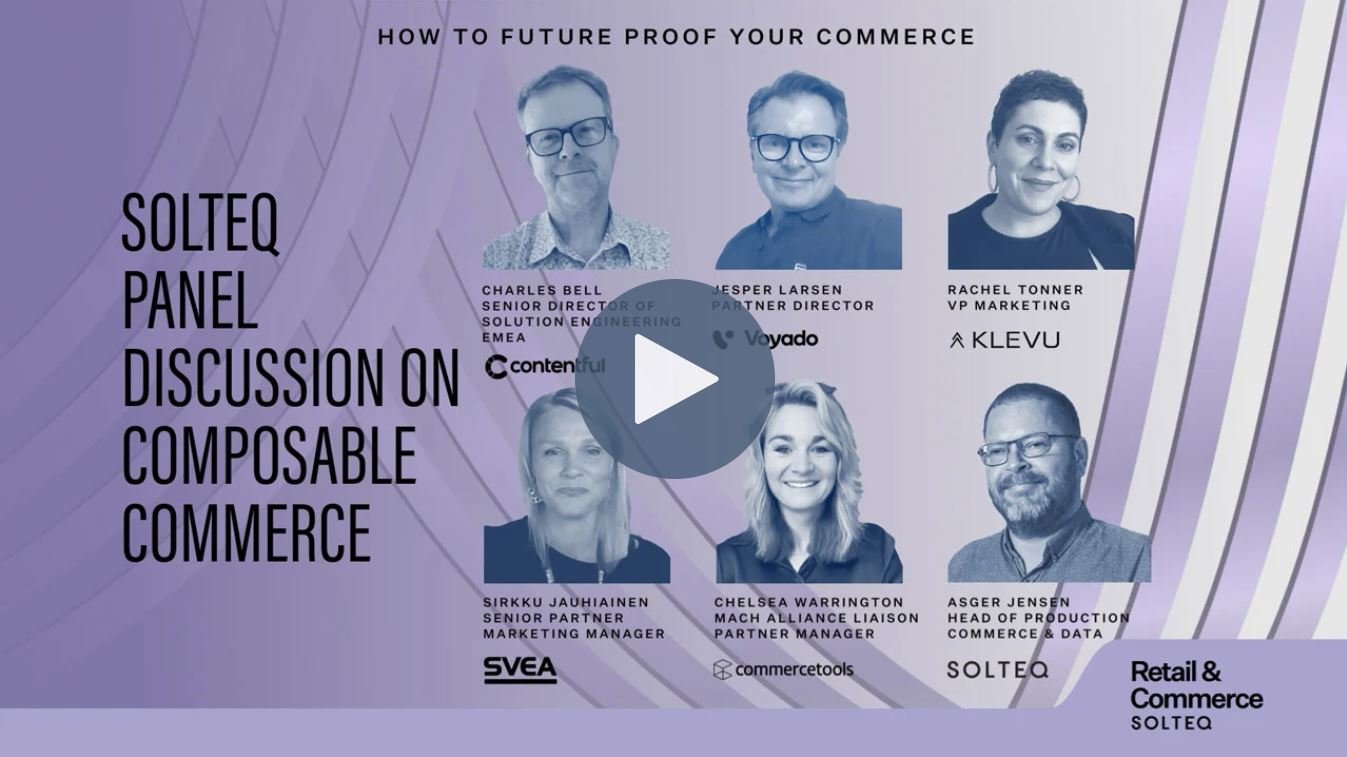

In Retail & Commerce, the comparable revenue, EUR 9.7 million, decreased by 7.1 percent relative to comparison period. The revenue development was affected by subdued customer demand and delays in several key customer acquisition opportunities. The efficiency measures implemented in the second and third quarters drove a comparable operating profit of EUR 1.0 million, an improvement of EUR 1.2 million, establishing the segment as the driving force behind the company’s improvement in results for the review period.

In Utilities, the comparable revenue was EUR 2.8 million, down by 27.0 percent relative to the comparison period. The disappointing revenue development was caused by delays in customer deliveries in the software business and weak customer demand in the consulting business. The comparable operating result was EUR -0.7 million, which improved by 15.7 percent relative to the comparison period.

During the review period, Danish healthcare software solutions, a part of the Retail & Commerce segment, were sold. The transaction was completed at the end of December 2024, and the net debt-free purchase price of the business was EUR 4.0 million. The transaction was a logical continuum to enhance the company’s focus on selected solutions and expert services in the energy sector, retail industry, and e-commerce. Furthermore, the transaction enables the company to decrease indebtedness and financing costs.

Overall, the year 2024 was a good one for Solteq. The company's comparable operating result turned positive and improved by more than EUR 5 million. I am very pleased with this performance. We aim to continue improving our results this year, and we are well-positioned to achieve that.

The market outlook for both segments is expected to be somewhat difficult. However, the markets are expected to stabilize gradually during the year, and the company is confident in its ability to consistently improve results.

Profit guidance 2025

Comparable revenue will decrease slightly, while the comparable operating result will improve significantly. Excluding the divested healthcare software solutions business, comparable revenue was EUR 48,818 thousand in the financial year 2024. Comparable operating result for the financial year 2024 was EUR 710 thousand.

Financial reporting

The Financial Statements Bulletin has been prepared in accordance with the recognition and valuation principles of IFRS standards and using IAS 34 and the same accounting policies as the Financial Statements 2023. The new IFRS standards, taken into use on January 1, 2024, do not have a significant impact on the Group’s Financial Statements Bulletin. The Financial Statements Bulletin is based on the audited Financial Statements of 2024.

Attachments

Solteq Plc Financial Statements Bulletin January 1 – December 31, 2024

Further information

CEO Aarne Aktan

Tel: +358 40 342 4440

E-mail: aarne.aktan@solteq.com

CFO, General Counsel Mikko Sairanen

Tel: +358 50 567 3421

E-mail: mikko.sairanen@solteq.com

Distribution

Nasdaq Helsinki

Key media

www.solteq.com

About Solteq

Solteq is a Nordic software solution and expert service provider specializing in retail and energy sectors and needs related to e-commerce. The company employs over 400 professionals and operates in Finland, Sweden, Norway, Denmark, Poland, and the UK.