Stock Exchange Bulletin

Interim Report

April 29, 2025, at 8.00 am

Profitability Improvement Continued.

January–March

-

Comparable revenue totaled EUR 12.1 million (13.1) and decreased by 7.2 percent. Revenue totaled EUR 12.1 million (13.6) and decreased by 10.7 percent

-

Comparable EBITDA was EUR 0.5 million (0.3) and EBITDA EUR 0.6 million (0.4). Comparable EBITDA percent was 4.5 (2.1)

-

Comparable operating result was EUR 0.1 million (-0.3) and operating result EUR 0.2 million

(-0.2). Comparable operating result percent was 1.1 (-2.3) -

Earnings per share was EUR -0.02 (-0.04)

-

Solteq Group’s equity ratio was 30.7 percent (30.2)

-

Net cash flow from operating activities was EUR 0.0 million (1.0)

-

Comparable revenue will decrease slightly, while the comparable operating result will improve significantly. Excluding the divested healthcare software solutions business, comparable revenue was EUR 48,818 thousand in the financial year 2024. Comparable operating result for the financial year 2024 was EUR 710 thousand.

Key figures

| 1-3/2025 | 1-3/2024 | Change % | 1-12/2024 | Rolling 12mos | |

| Revenue, TEUR | 12,121 | 13,571 | -10.7 | 50,869 | 49,419 |

| Comparable revenue, TEUR | 12,126 | 13,066 | -7.2 | 48,818 | 47,877 |

| EBITDA, TEUR | 562 | 358 | 57.2 | 4,073 | 4,278 |

| Comparable EBITDA, TEUR | 543 | 281 | 93.4 | 2,539 | 2,802 |

| Operating result, TEUR | 153 | -247 | 161.8 | 1,809 | 2,209 |

| Comparable operating result, TEUR | 134 | -306 | 143.9 | 369 | 809 |

| Result for the financial period, TEUR | -462 | -705 | 34.5 | -1,211 | -967 |

| Earnings per share, EUR | -0.02 | -0.04 | 34.5 | -0.06 | -0.05 |

| Operating result, % | 1.3 | -1.8 | 3.6 | 4.5 | |

| Comparable operating result, % | 1.1 | -2.3 | 0.8 | 1.7 | |

| Equity ratio, % * | 30.7 | 30.2 | 30.9 | 30.5 |

* The comparative information for 1-3/2024 has been adjusted; deferred tax assets and deferred tax liabilities are presented on a net basis. In the comparison period they were presented on a gross basis.

CEO Aarne Aktan: Profitability Improvement Continued.

The first quarter was moderate. While revenue declined, profitability continued to improve. This was the fifth consecutive quarter in which a comparable operating result improved year-on-year and the fourth in a row with a positive operating result. Performance was in line with our expectations, and the improved profitability reflects the impact of the efficiency and cost-saving measures in 2024.

The Group's comparable revenue for the review period was EUR 12.1 million, a decrease of EUR 0.9 million relative to the comparison period. The comparable operating result amounted to EUR 0.1 million, marking an improvement of EUR 0.4 million year-on-year. This was a significant achievement in a market characterized by cautious customer demand, postponed investment decisions, and global economic turmoil.

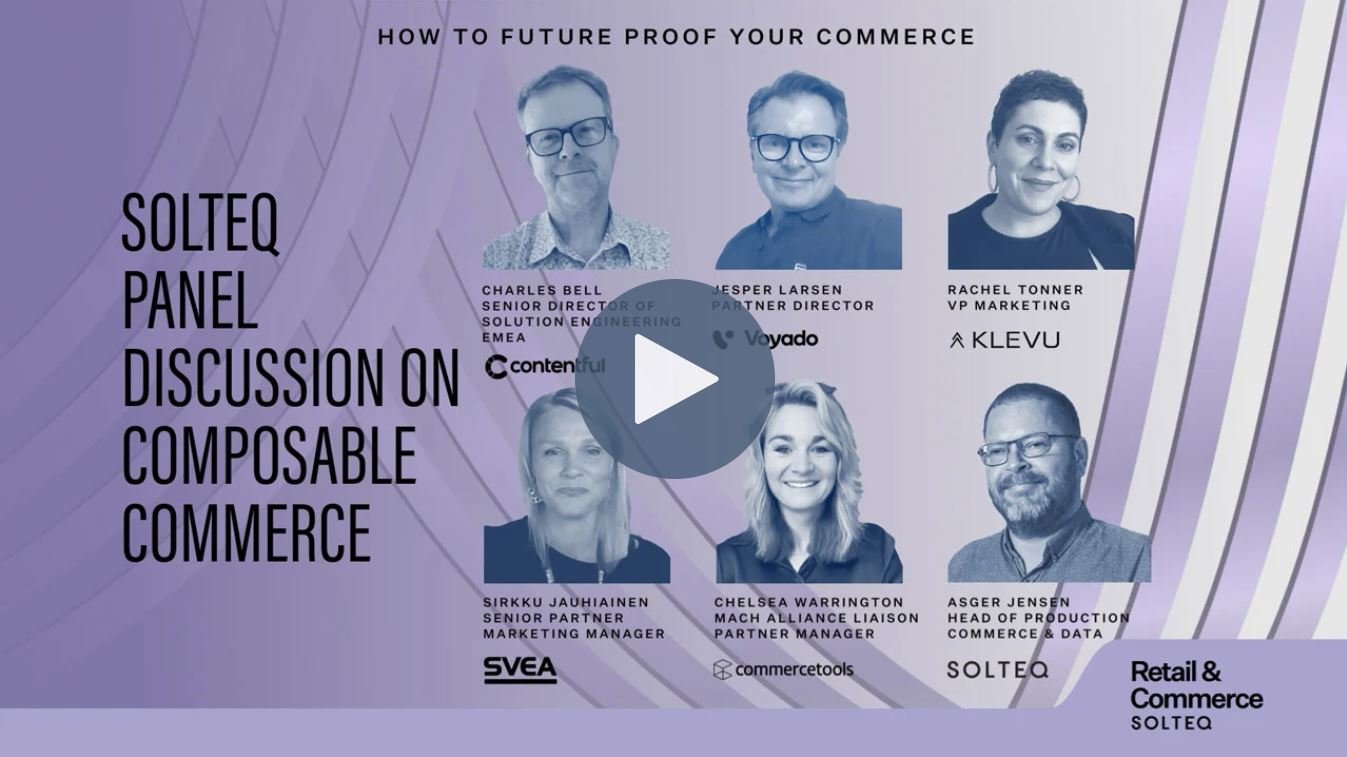

The comparable revenue for the Retail & Commerce segment was EUR 9.2 million, a decrease of EUR 0.7 million from the comparison period. However, due to successful efficiency and cost-saving initiatives, the segment's comparable operating result reached EUR 0.7 million, increasing by EUR 0.4 million year-on-year.

In the Utilities segment, revenue totaled EUR 2.9 million, down by EUR 0.3 million from the comparison period. The decline in revenue was primarily driven by weak demand in the consulting business. On the other hand, the share of SaaS-based fees in the software business increased, and recurring services accounted for over 50% of the segment’s revenue. The segment’s comparable operating result was EUR -0.6 million, an improvement of EUR 48 thousand year-on-year. The segment’s performance is expected to improve over the remainder of the year.

During the review period, the company cancelled notes, repurchased between 2023 and 2025, worth EUR 4.3 million. These cancellations strengthen the company's financial position and reduce interest expenses. Following the cancellations, the outstanding amount of the bond is EUR 18.7 million.

Despite the challenging operating environment and global economic conditions, the outlook for the Retail & Commerce segment remains moderate. The market outlook for the Utilities segment is stable, with the Nordic region offering growth opportunities for both software and expert services businesses. Overall, we remain confident in our ability to consistently improve results during the current financial year.

Profit Guidance 2025

Comparable revenue will decrease slightly, while the comparable operating result will improve significantly. Excluding the divested healthcare software solutions business, comparable revenue was EUR 48,818 thousand in the financial year 2024. Comparable operating result for the financial year 2024 was EUR 710 thousand.

Financial reporting

The Interim Report has been prepared in accordance with the recognition and valuation principles of IFRS standards and using IAS 34 and the same accounting policies as the Financial Statements 2024. The new IFRS standards, taken into use on January 1, 2025, do not have a significant impact on the Group’s Interim Report. The information presented in the Interim Report has not been audited.

Attachments

Solteq Plc’s Interim Report January 1 – March 31, 2025

Further Information

CEO Aarne Aktan

Tel: +358 40 342 4440

E-mail: aarne.aktan@solteq.com

CFO, General Counsel Mikko Sairanen

Tel: +358 50 567 3421

E-mail: mikko.sairanen@solteq.com

Distribution

Nasdaq Helsinki

Key media

www.solteq.com

Solteq in brief

Solteq is a Nordic software solution and expert service provider specializing in retail and energy sectors and needs related to e-commerce. The company employs over 400 professionals and operates in Finland, Sweden, Norway, Denmark, Poland, and the UK.